Dear reader, welcome!

If you know me well, you will probably be re-reading the title again to ensure you read it properly. Yes! you got that right. I have largely not been involved in this rally for several reasons. Some are that:

. I wasn't sitting on cash

. I had abandoned my dollar cost averaging (DCA) crypto investing style a long time ago.

. Other financial assets and markets were of more interest to me.

. Perhaps I was just foolish hahaha

However, truth be told, it did initially hurt to not be part of it, and to make it worse, the only amount of BTC I hold is locked up with one of the brokers I used to trade with. Now I can't access it but hopefully one day. So let's get to the nitty-gritty, shall we?

In 2021, I wrote a piece in support of cryptocurrencies, especially BTC. I look at the price today and it still baffles me how I missed the whole move despite calling and forecasting for it to make all-time highs (ATH)by this period. Perhaps the naivety and inexperience of a market participant who is fairly new to the markets (2+ years). But that's not something to dwell on, for the literature shows us that, markets rise and fall. So, discounted prices will always present themselves and offer opportunities.

That is a chart I shared with a fellow colleague explaining why I was predicting Bitcoin to be way up by this time. Though it broke lower to about $ 16,000, before making this high, I still didn't buy it. And the following image shows my reasoning for why I expected BTC to rally.

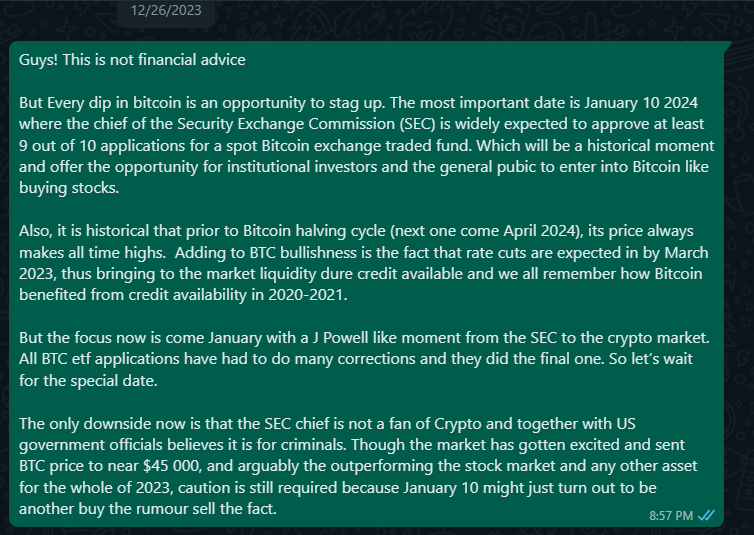

Haha! you would think by 2024, I would have learned a lesson but perhaps, I had taken it upon myself to use the moment as a learning opportunity and I will be vulnerable and say, that most of my investments by this time had negative returns and I was in a risk-off mood. Late December (26) 2023, I was in again forecasting BTC to make those highs and telling those within my circle to load up on it. At this point, I failed and didn't buy but was close to buying due to the facts stated in my letter as seen in the WhatsApp chat below.

I believe it is George Soros who once said and I paraphrase " What matters is how much more you make when right and how less you lose when wrong". I guess it's fair to conclude that I have turned out to be a spectacle of how much you lose when right. Yes! I have lost because the opportunity cost of being right and not participating in the rally makes me a loser. Does that bother me? Absolutely not but it did hurt a little and I'm over that now. A lesson learned from mistakes makes you experienced for the next opportunity. In finance, behavior is much more important in the actual money-making process as you have read in this piece. I cannot count how many times I have been right in the markets and not made money out of it. Whether, stocks, forex, bonds, or currencies, I seem to come up short at pulling the trigger sometimes. I'm still a baby, but like a baby, he must first learn to crawl before he walks. Give it time they say. Let's wrap this up.

So when can I anticipate buying again? well, literature and past prices show that BTC always hits ATH after a halving cycle. So, April 19th, 2024 is the date for the next Bitcoin halving and one should expect a dip and then a rally in the price. Also, the US markets are expecting a recession or at least some cracks to show that its economy is weakening. If this happens, then we will expect the US Federal Reserve to start cutting rates as the economy slows down. This will mean full risk-on mood and it is at this point that I intend to be a participant once more in my favorite beloved BTC. However, a dip must occur because it is the universal law of markets to BUY LOW and SELL HIGH. Right now, Bitcoin is high for me to buy.

To conclude, I want to say, that while it appears like a loss, and if you're like me and didn't buy or add more to your holding, never beat yourself over it. Experience has taught me that markets are always discounting. Meaning the next opportunity is just around the corner.

Comments

Post a Comment